Loans

Whether you’re starting a business, sending a kid to school or coping from a financial setback, our flexible loan arrangements let you comfortably and efficiently get the assistance you need to reach your goals for you and your family.

Our diverse range of products and services were and are continuously examined by our leaders to better cater to the needs of the community.

Loans

From your simplest financial need to your greatest financial goal, we’re here for you every step of the way.

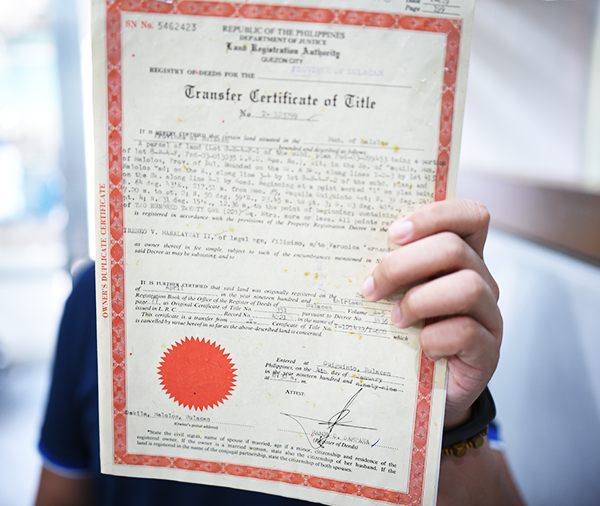

Collateral Loan

By using land title as collateral, the member can take advantage of larger loans. The location of the property should be within Bulacan.

Maximum Loanable Amount – 50% to 60% of Appraised Value

Term – 1 to 5 years

Interest (add-on) – 16% P.A. diminishing

Deductions:

Filing Fee: 2-3%

Share Capital: 10%

Loan Guaranty Fund: 1% to 3%

Savings Deposit: ₱ 200.00

Commodity Loan

A type of loan wherein the member gets a certain commodity like appliances even with no co-maker, as long as the share capital of the member is enough to cover the cost of the appliances.

Maximum Loanable Amount – Actual Cost of Appliance

Term – 1 month to 1 year

Interest (add-on) – 14-15% P.A. diminishing

Deductions:

Filing Fee: 2-3%

Share Capital: 2%

Loan Guaranty Fund: 1%

Savings Deposit: ₱ 200

Housing Loan

Nothing beats the comfort of having your own home for your family. You can finally fulfill your dreams through this loan.

Maximum Loanable Amount – Price of House & Lot or Lot only

Term – Lot Loan – 1 to 10 years

House and Lot Loan – 1 to 15 years

Interest (add-on) – 14% P.A. diminishing

Amount to be paid:

Downpayment -20% of House/Lot Price

Filing Fee – 2% of loan amount

Share Capital – 5% of loan amount (Additional P500 share capital per months on term of loan)

Loan Guaranty Fund – 1% of loan amount balance per year

Memorial Loan

A member can avail of Memorial Loan. The Total Lot Price includes Maintenance Fee.

Maximum Loanable Amount – Lot Price

Term – 1 to 5 years

Interest (add-on) – 16% P.A. diminishing

Amount to be paid:

Downpayment -20% of Lot Price &Perpetual Fund

Filing Fee – 2% of loan amount

Share Capital – 5% of loan amount (Additional P500 share capital per months on term of loan)

Loan Guaranty Fund – 1–2%

Rice Loan

A typical Filipino family cannot survive without rice on the table. That’s why SPMPC offers rice loans so members can acquire this necessity same day he applied. The term of the loan is one (1) to two

(2) months. Interest is 2% per month

SM Credit Loan

A member can avail of SM Shop Card. A credit limit will be assigned to the member depending on his share capital. The credit limit can be use monthly.

Maximum Loanable Amount – Credit limit set by SPMPC base on Share Capital

Term – 2 months

Interest (add-on) – 16% P.A. diminishing

Deductions:

Filing Fee: 2%

Loan Guaranty Fund: 1%

Tricycle/Motor Loan

A privilege wherein the members can get a tricycle service in a loan arrangement which he/she can use for additional income for the family.

Maximum Loanable Amount –

Actual Cost of Tricycle/Motor

Term – 1 to 3 years

Interest (add-on) – 16% P.A. diminishing

Deductions:

Filing Fee: 3%

Share Capital: 10% of loan amt.

Loan Guaranty Fund: 1% to 2%

Savings Deposit: ₱ 200.00

Provident loan

The amount of loan depends on the member’s capacity, character, capital, collateral and condition. The maximum loanable amount varies every year of membership.

Maximum Loanable Amount – ₱ 200,000.00

A.

Term – 1 month to 1 year

Interest (add-on) – 16% P.A. diminishing

Deductions:

Filing Fee: 2-3%

Share Capital: 2%

Loan Guaranty Fund: 1%

Savings Deposit: ₱ 200.00

B. MIGS (Member in Good Standing)

Term – 1 month to 3 years (monthly amortization)

Interest (add-on) – 14% P.A. diminishing

Deductions:

Filing Fee: 2-3%

Share Capital: 2%

Loan Guaranty Fund: 1%

Savings Deposit: ₱ 200.00

Seasonal Loan

Agricultural loan that can be availed by farmers. The loan is payable after the member’s harvest or if the member used the loan for backyard piggery, upon the sale of the farm animals.

Maximum Loanable Amount – ₱ 200,000.00

Term – 3 months or 5 months (payable at the end of term)

Interest (add-on) – 12% P.A. (flat rate 1%/mo.)

Deductions:

Filing Fee: 2%

Share Capital: 2%

Loan Guaranty Fund: 1%

Savings Deposit: ₱ 200.00

Character Loan

The amount of loan is equal to the share capital of the member less P1,500.00 or amount of Savings/ Time Deposit that will be put on hold depending on the term of the loan. No co-maker is required.

Maximum Loanable Amount –

Amount of Share Capital less ₱ 1,500.00 or

Amount of Savings/ Time Deposit (back to back loan)

Term – 1 month to 3 years (monthly amortization)

Interest (add-on) – 12% P.A. diminishing

Deductions:

Filing Fee: 2-3%

Share Capital: 2%

Loan Guaranty Fund: 1%

Savings Deposit: ₱ 200.00

BE A MEMBER TODAY!

We’re in the business of providing financial solutions for the welfare of our members and it is our commitment to uplift their quality of life through our flexible loan arrangements and growing range of investments.

Contact

Get In Touch

Address

333 Bonifacio St., San Pablo, City of Malolos, Bulacan

Contact Number

Telephone Nos.

044 – 7912152

044 – 3050780

Cellphone Nos.

0916 – 6427419

Email Address

Operating Hours

Mondays to Fridays

8:00 am – 12:00 pm

1:00 pm – 5:00 pm

Saturdays

8:00 am – 12:00 pm

(except holidays)